Do you feel as though your hard-earned money is disappearing like sand from your fingers? You’re not by yourself. Money management can be challenging, particularly if you lack a clear strategy. The 50-30-20 budget rule is applicable in this situation. It’s a straightforward but effective framework that can assist you in taking charge of your money and achieving your financial objectives.

Consider this: You don’t have to wonder where your money is going or feel stressed out by bills because you have a methodical spending approach. You are well aware of how much you can spend on fun activities, necessities, and future development. It sounds pretty good, doesn’t it?

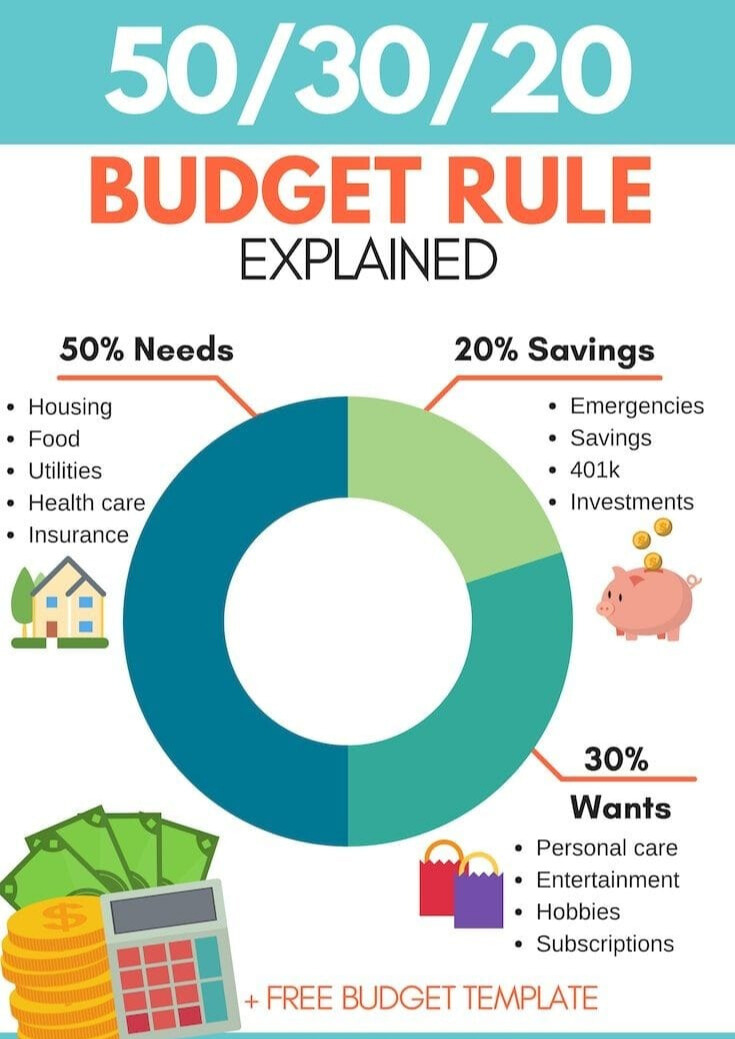

So what exactly is the rule 50-30-20?

Consider it as separating your earnings into three categories:

• 50% for necessities: This addresses your necessities, the things that are essential to your life and cannot be compromised. This includes minimum debt payments, groceries, utilities, rent or a mortgage, and transportation.

• 30% for Wants: This is for the enjoyable things in life, the extra money you spend on things that make you happy. Consider eating out, leisure activities, hobbies, travel, and shopping. Recall that prudent money management does not entail self-deprivation!

• 20% for Debt Repayment and Savings: This is where you make investments in your future and increase your financial stability. Use this amount to pay down debt, establish an emergency fund, or save for retirement. Never forget that having enough money brings peace of mind!

Why does the 50–30–20 rule work so well?

• Easy to Understand and Simple: Spreadsheets or intricate calculations are not necessary. Just three unambiguous percentages to remember.

• Offers Structure: You can avoid overspending and impulsive purchases by knowing exactly how much you can spend on each category.

Promotes Saving and Debt Repayment: By setting aside 20% on a regular basis, you’re actively pursuing your financial objectives.

• Adaptable: Modify the percentages to suit your particular requirements and circumstances. Perhaps the high cost of housing has made you need more for Needs, or you want to put saving for a major purchase first.

Starting to Apply the 50-30-20 Rule:

1. Track Your Expenses and Income: Determine how much money you are making and where it is going. This helps you see your spending patterns clearly.

2. Determine Your Net Income: To determine your usable amount, deduct taxes and automatic deductions from your gross income.

3. Assign According to the Rule: To calculate the amounts in each category of your budget, multiply your net income by 50%, 30%, and 20%.

4. Monitor Your Development: Review your budget often and make any necessary adjustments. Recognize your own shortcomings and adjust the percentages if necessary.

Success Tips:

• Make Use of Budgeting Tools: Mint, YNAB, and Personal Capital are just a few of the many useful apps and software that can make budgeting easier.

• Automate Finances: To make saving simple, set up automatic transfers to investment and savings accounts. Give technology a job to do for you!

• Review Often: Your goals and financial requirements may change over time, so review and adjust your budget every few months.

• Be Flexible: Rather than being a strict rule, the 50-30-20 rule is a guideline. To suit your particular situation, modify the percentages.

Recall that the 50-30-20 rule is merely a guideline. Finding a budgeting method that suits your needs and advances your financial objectives is crucial.

Good information