Dealing with the aftermath of a car twist of fate or car damage can be demanding. Fortunately, Liberty General Insurance makes the technique a bit less difficult with their honest motor claim form. If you discover yourself needing to file a claim, here’s a step-by means of-step guide liberty motor claim form

Understanding the Liberty Motor Claim Form

The Liberty motor declare form is designed to collect all the important records approximately the incident involving your vehicle. This includes details about the coincidence, the volume of the damage, and any accidents sustained. Filling out this form appropriately is important to ensure your declare is processed easily and promptly.

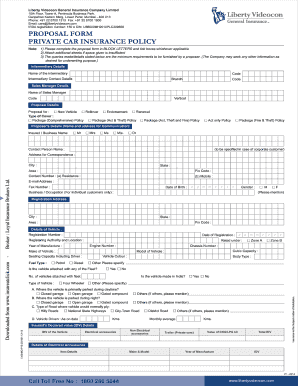

Download liberty motor claim form here:

Step-through-Step Guide to Filling Out the Form

- Personal Information

- Start through imparting your personal details including your call, cope with, and get in touch with records. Make positive all the data is up-to-date to avoid any communique problems.

- Policy Details

- Enter your policy wide variety and different relevant details about your coverage coverage. Having your coverage files on hand will make this step faster.

- Vehicle Information

- Provide data about your vehicle, consisting of the make, model, registration wide variety, and any modifications that is probably applicable to the claim.

- Details of the Incident

- Describe the incident in detail. Include the date, time, and vicinity of the accident or damage. Be as precise as viable about what took place, and fasten any snap shots or diagrams if important.

- Damage Assessment

- Detail the harm for your vehicle. Mention which elements are damaged and the quantity of the harm. If there have been any accidents, consist of details about them as well.

- Witness Information

- If there have been any witnesses to the incident, provide their names and call records. Witnesses can be crucial in substantiating your claim.

- Police Report

- If the incident worried any other automobile or led to huge damage or damage, you would possibly want to provide a duplicate of the police record. This adds credibility on your declare.

- Repair Estimates

- Include estimates for the fee of upkeep. It’s frequently helpful to get multiple estimates from specific repair shops to ensure you have got a complete view of the potential charges.

Tips for a Smooth Claim Process

- Be Honest and Accurate: Providing correct and honest statistics is important. Any discrepancies can postpone the claim system or maybe bring about a denial.

- Keep Copies: Always hold copies of the finished shape and any supporting documents. This can be useful on your facts and if any issues stand up.

- Follow Up: Stay in touch with Liberty General Insurance to check the repute of your claim. Regular follow-americacan assist expedite the method.

Conclusion

Filing a motor declare with Liberty General Insurance doesn’t should be a daunting project. By following this manual, you can navigate the Liberty motor claim shape with self belief, making sure a smoother and faster claims system. Remember, accurate and thorough facts is prime to a a hit claim.