Hi there. Today, I want to talk about something close to all our hearts: our children’s future. Let’s face it, planning for your child’s education, wedding, or any other major milestone can feel overwhelming. But fret not, parents! LIC (Life Insurance Corporation of India) offers a fantastic tool to help you navigate this journey – the LIC Child Money Back Plan Calculator.

What is a Child Money Back Plan?

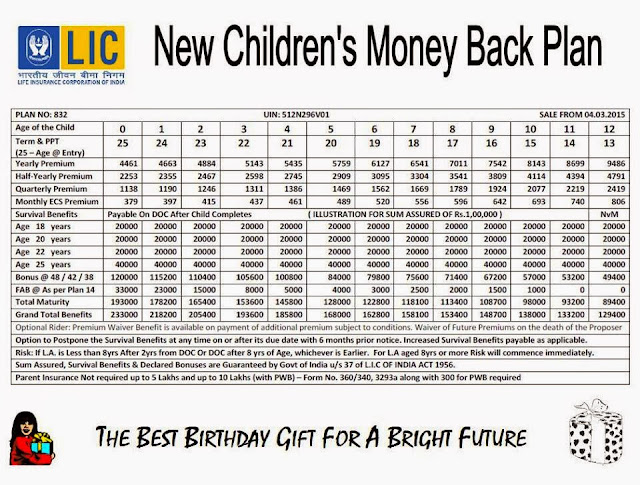

Before diving into the calculator, let’s understand what this plan is all about. An LIC Child Money Back Plan is a life insurance policy designed specifically for children. It provides a combination of benefits:

- Life Cover: This ensures your child’s future financially even in your absence.

- Maturity Benefit: A lump sum payout is received upon policy maturity (usually when your child reaches a certain age).

- Survival Benefits: This plan offers periodic payouts throughout the policy term, acting as milestones to support your child’s needs as they grow.

Why Use the LIC Child Money Back Plan Calculator?

This nifty online tool helps you:

- Plan Affordably: Input your child’s age, desired sum assured (coverage amount), and policy term. The calculator estimates the monthly premium you’d need to pay.

- Set Realistic Goals: Get a sense of the total maturity benefit you can expect, considering factors like policy term and bonuses.

- Compare Plans: Some insurance companies offer variations of child money back plans. The calculator allows you to compare plans from LIC to find the best fit for your needs.

Here’s a table summarizing the benefits of using the calculator:

| Benefit | Description |

|---|---|

| Financial Planning | Estimate costs and set realistic goals. |

| Affordability | Understand the financial commitment involved. |

| Plan Comparison | Compare different child money back plans offered by LIC. |

Using the LIC Child Money Back Plan Calculator

Using the calculator is a breeze! Here’s a quick guide:

- Visit the LIC website or a trusted insurance broker’s website.

- Look for the “Child Money Back Plan Calculator” section.

- Enter your child’s date of birth (this will calculate their current age).

- Choose the desired sum assured (coverage amount).

- Select the preferred policy term (typically 18-25 years).

- Click “Calculate” and see your estimated premium and maturity benefit.

Calculate Your LIC Child Money Back Plan

Important Considerations

Remember, the calculator provides an estimate. Final premiums and benefits might vary slightly based on your specific circumstances and the chosen plan variant.

Beyond the Calculator

While the calculator is a fantastic starting point, here are some additional tips for choosing a child money back plan:

- Consult an Insurance Advisor: Discuss your child’s future needs and get personalized recommendations.

- Factor in Inflation: Consider the rising cost of education and other expenses when choosing the sum assured.

- Review Policy Wording: Understand the terms and conditions, including exclusions and claim procedures.

Conclusion

Planning for your child’s future is an act of love. The LIC Child Money Back Plan Calculator empowers you to make informed decisions. Remember, this is just one tool in your financial planning toolbox. So, use the calculator, talk to an advisor, and secure a bright future for your precious one!

Disclaimer: I am not a financial advisor, and this blog is for informational purposes only. Please consult with a qualified professional for personalized financial advice.