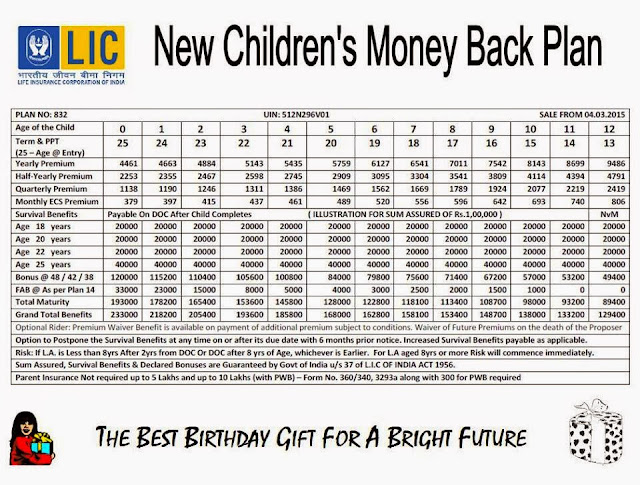

Secure Your Child’s Future: LIC Child Money Back Plan Calculator 2024

Hi there. Today, I want to talk about something close to all our hearts: our children’s future. Let’s face it, planning for your child’s education, wedding, or any other major milestone can feel overwhelming. But fret not, parents! LIC (Life Insurance Corporation of India) offers a fantastic tool to help you navigate this journey – … Read more