A type of insurance known as personal accident insurance (PAI) offers financial security in the case of an unavoidable death, dismemberment, or disability. It is a cost-effective and beneficial coverage that can aid in easing the financial burden of an accident for both people and families.In this blog Find benefits of personal accident insurance,Personal accident insurance features, and much more

Benefits of personal accident insurance

Personal accident insurance offers the following primary advantages:

• Financial security for your family: If you are your family’s only source of income, an untimely death or incapacity could put them in a precarious financial position. To assist your loved ones in paying for funeral costs, unpaid debts, and other living needs, PAI might offer a lump sum payment.

• Peace of mind: You may feel more at ease knowing that you and your family are covered financially in the case of an accident. This frees your mind from financial concerns so that you may concentrate on getting better or enjoy time with your loved ones.

• Cost: Personal accident insurance is a very cost-effective form of coverage. You can purchase a big sum insured policy for a comparatively low price.

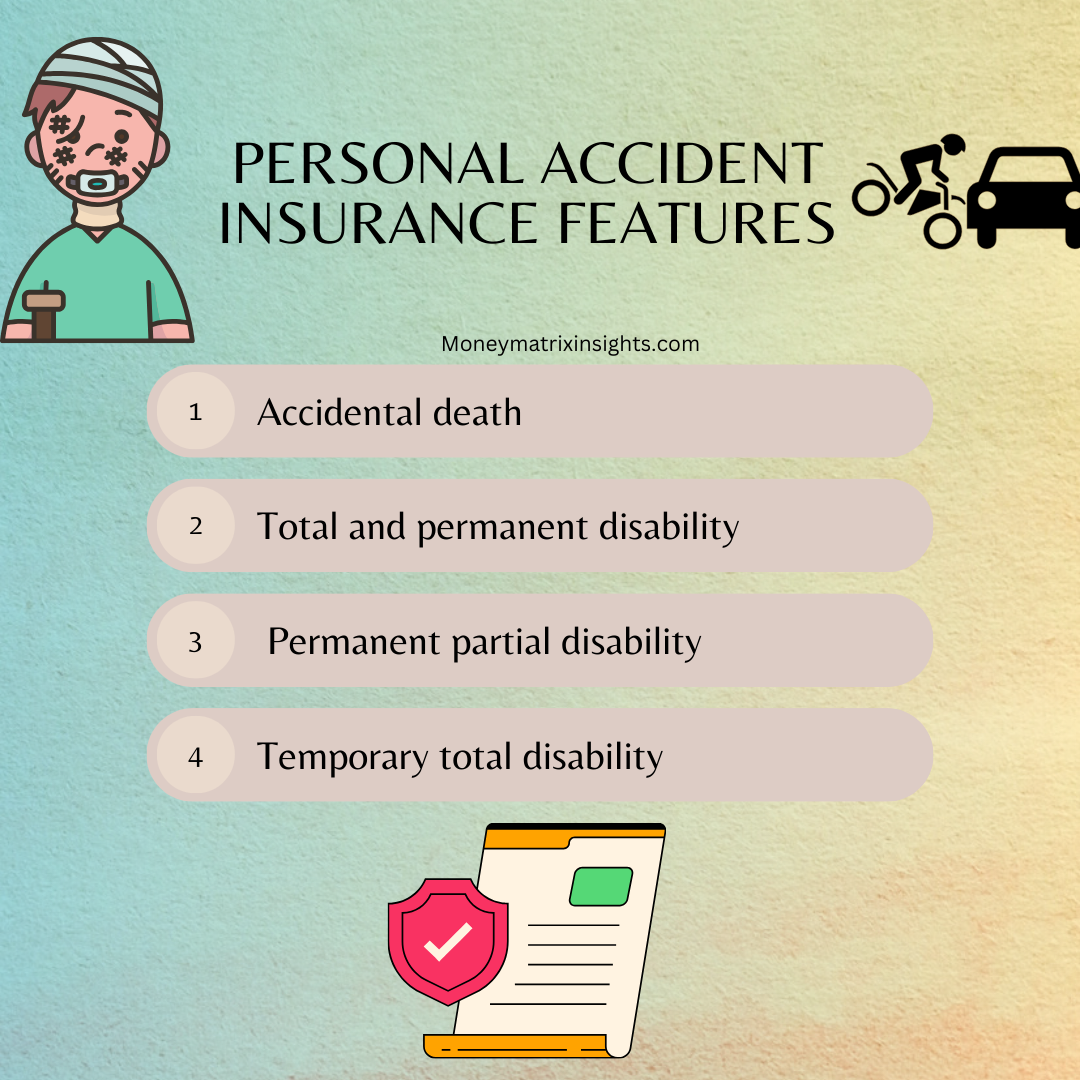

Personal accident insurance features

The following are frequently included in personal accident insurance policies:

- Accidental death: Your nominee will be given a lump sum payment if you pass away in an accident.

- Total and permanent disability: If an accident leaves you permanently incapacitated and unable to work, you will get a lump sum payout.

- Permanent partial disability: If you lose a limb or an eye in an accident, you will receive a lump sum payment based on the extent of your disability.

- Temporary total disability: If an accident leaves you temporarily disabled and unable to work, you will get a weekly or monthly benefit until you can resume your job.

Most recent statistics on accidental deaths and disabilities in India

The National Crime Records Bureau (NCRB) estimates that in India in 2021, there were around 4.25 lakh unintentional deaths. This indicates that more than 1,160 people pass away in accidents per day. Over 15 lakh individuals were hurt in accidents in 2021, according to the NCRB.

Road accidents cause over 60% of all accidental deaths in India, making them the leading cause.. Falls, drowning, and fire are some additional prevalent causes of accidental fatality.

Who ought to purchase personal accident coverage?

Everyone should have personal accident insurance, but the following individuals require it more than most:

• Those who have dependents: In the event of your accidental death or disability, PAI can assist in securing their financial security if you have dependents, such as a spouse, children, or elderly parents.

• Those who work in high-risk professions: If you drive a truck or work as a construction worker, you are more likely to be in an accident. In the event of an accident, PAI may offer you extra financial protection.

• Those who lead lavish lifestyles: In the event of your accidental death or disability, PAI can help shield your family from financial hardship if you lead an expensive lifestyle with multiple car payments or a large mortgage.

Selecting a Personal Accident policy

When choosing a Personal Accident Insurance policy, consider the following elements:

• Sum insured: In the event of an unintentional death or disability, the insurance company will pay up to the sum insured. You should pick an insurance amount that will cover both your needs and the needs of your dependents.

• Coverage: Policies for personal accident insurance typically provide coverage for a range of risks, including accidental death, permanent total disability, permanent partial disability, and temporary total disability. You ought to pick a policy that addresses the risks that matter to you the most.

• Premium: You pay a premium when you purchase a Personal Accident Insurance policy. The amount insured, the level of coverage, as well as your age and line of work, affect premiums. Before selecting a policy, you should compare the premiums offered by various insurance providers.

Conclusion

In the event of an accident, Personal Accident Insurance can offer individuals and families with valuable and affordable financial protection. Everyone should have personal accident insurance, but those with dependents, risky jobs, or expensive lifestyles should prioritize it above all others.

Additional advice for purchasing personal accident insurance is provided here:

• Before purchasing the policy, carefully read the document. This will assist you in comprehending the policy’s coverage, exclusions, and terms and conditions.

• Prior to purchasing an insurance policy, compare those offered by various providers. This will enable you to obtain the best possible insurance rate.