In the dynamic realm of personal finance, where investment approaches change and economic

conditions fluctuate, achieving financial stability and long-term wealth may appear like an

overwhelming challenge. But you can overcome the challenges of handling your money, reaching

your objectives, and safeguarding your future with a well-organizedfin fin plan.

From laying a solid financial foundation to accumulating wealth and getting ready for retirement, a

thorough financial plan acts as a roadmap to help you through every step of your financial journey. It

takes a comprehensive approach, taking into account not only your present financial condition but

also your goals for the future and any hazards.

In order to design a financial plan(fin plan) that suits your goals and particular situation, it is necessary to take into account the following seven pillars:

- Setting Financial Objectives:

Setting definite, well-defined financial goals is the first step toward financial success. These

objectives ought to cover both short- and long-term goals, giving your financial journey a concrete

end point.

Short-term objectives could be paying off credit card debt, funding a dream vacation, or saving for a

down payment on a home. Long-term objectives can include becoming financially independent,

securing a comfortable retirement, or paying for your kids’ education.

Having a clear understanding of your financial objectives gives you focus and drive, which enables

you to make well-informed decisions that support your goals.

- Evaluating Your Current Financial Situation:

It’s critical to have a thorough grasp of your current financial situation before setting out on your

financial journey. This entails evaluating your assets, liabilities, income, and expenses in detail.

Tracking your income from all sources—including work, investments, and other sources of

income—should be your first step. Then, keep a close eye on your spending and divide it into three

categories: debt repayment, discretionary spending, and living expenses.

Determine your assets, which could include investments, cash on hand, real estate, and personal

belongings. Lastly, assess your debts, including mortgages, student loans, and credit card debt.

With the help of this thorough financial assessment, you can see your financial situation clearly and

decide where you can make improvements.

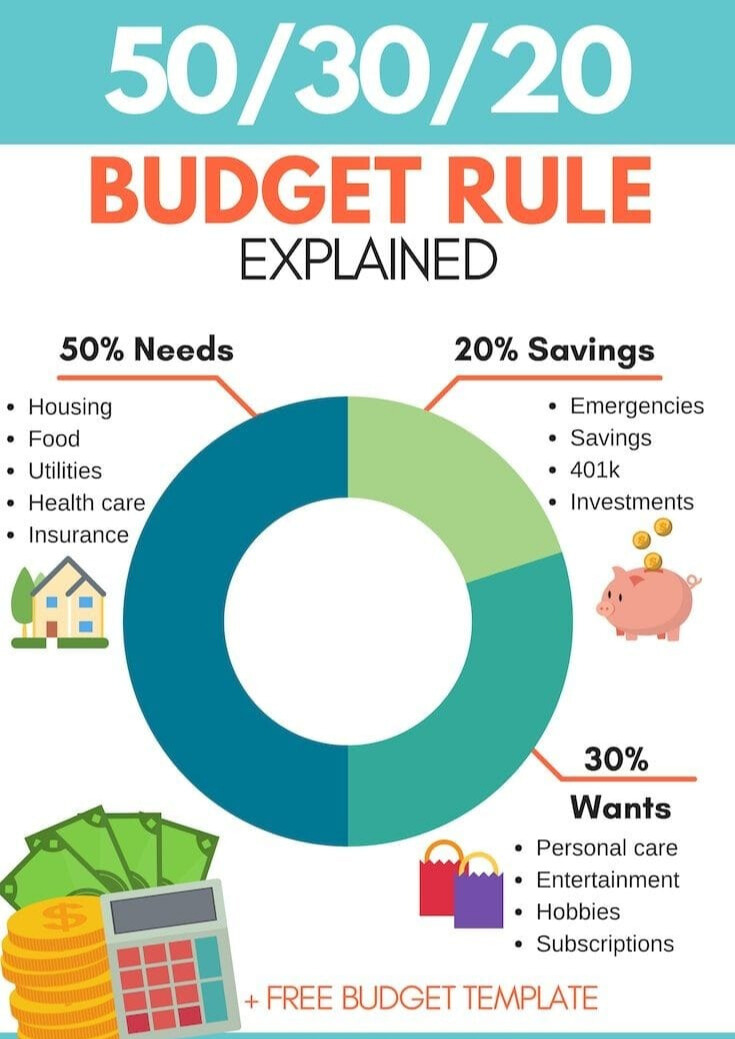

- Making a Budget and Monitoring Your Expenses:

A budget is the foundation of sound financial management since it offers a structure for wisely

dividing your earnings. Make sure that your spending is in line with your financial objectives by

creating a thorough budget that details your monthly income and expenses.

Sort your spending into two categories: discretionary (such as entertainment and eating out) and

necessary (such as housing, utilities, and groceries). Set aside money for savings and debt

repayment, and prioritize your most important costs.

Keep a regular check on your spending patterns by tracking your progress with spreadsheets or

budgeting apps. Determine areas where you can reduce wasteful spending to free up money for

debt reduction or savings.

- Creating an Emergency Fund:

Unexpected events can upset your financial stability because life is unpredictable. Create an

emergency fund to protect against unforeseen events like losing your job, having medical problems,

or needing auto repairs.

Try to accumulate three or six months’ worth of necessary living expenses in a conveniently located

savings account. This safety net keeps you from depending on debt in hard times and gives you

peace of mind.

- Effectively Managing Your Debt:

Your capacity to reach long-term objectives and financial stability can be seriously hampered by

debt. Make paying off debt a priority, beginning with high-interest loans like credit cards.

To lessen the total amount of debt you have, think about refinancing at a lower interest rate or

consolidating your debts. Create a budget-friendly debt repayment plan and make a commitment to

paying your bills on time until they are paid off.

- What is miscellaneous insurance?Your Everyday Safety Net

- can we claim 2 term insurance from two companies?

- Insurance Surveyor Eligibility: Requirements and Qualifications Explained

- LIC Agent Exam Fees : Know everything

- IRDA online exam payment

- Retirement Planning:

Although it may seem far off, it’s never too early to begin making financial plans for the future. The

more time you give your investments to grow through compound interest, the earlier you start

saving for retirement.

Make use of retirement plans offered by your employer, such as PFs (Pension Funds or Provident

Funds), which frequently have employer matching contributions. To optimize tax advantages and

increase your retirement savings, you should also think about investing in MF, PPF, NPS.

To find the best retirement savings plan for your age, risk tolerance, and financial objectives, speak

with a financial advisor.

- Using Insurance to Protect Yourself:

Insurance is an essential financial safety net against unanticipated events that could seriously affect

your finances. Check your policies for life, health, and property insurance to make sure you have

enough coverage for your needs.

As you get older, think about getting long-term care insurance because it can shield you financially

from the exorbitant costs of long-term care services.

Keep in mind that your financial plan is a dynamic document that needs to be reviewed and

updated on a regular basis to take your evolving situation and financial objectives into account. If

you require individualized help in developing and overseeing your financial plan, consult a

financial advisor.